Technology, on its own, becomes a double-edged sword for the financial industry. While it can bring in innovation and drive growth, it at the same time exposes institutions to new and maturing types of cyber risk. Much of the need for implementation of DORA and cyber resilience is, in respect, critical for the equipping of institutions to defend, manage, and recover from exposure to cyber-attacks. In addition to the above, DORA ensures resilience to all kinds of ICT disruptions and threats in financial institutions, guaranteeing core operations resistant to, tolerant of, responsive to, and recoverable from disruptions.

Why is Cyber Resilience So Important?

Cyberattacks are growing in sophistication and frequency, making financial institutions prime targets. A successful attack can disrupt operations, erode customer trust, and inflict significant financial damage. The domino effect can even impact the entire financial system. Therefore, the importance of cyber resilience in the financial sector cannot be overstated.

Understanding Cyber Resilience

Cyber resilience refers to an organization’s ability to prepare for, respond to, and recover from cyber-attacks. Unlike traditional cybersecurity measures, which focus primarily on preventing breaches, cyber resilience encompasses a broader approach. It ensures that businesses can maintain continuous operations even when an attack occurs. Key components of cyber resilience include:

- Preparation: Establishing protocols and defenses to prevent attacks.

- Response: Implementing effective measures to detect and mitigate attacks as they happen.

- Recovery: Ensuring rapid restoration of normal operations post-attack.

DORA Implementation: Fortifying the Financial Landscape

The Digital Operational Resilience Act (DORA) is an EU regulation that came into force on January 16, 2023, and will apply from January 17, 2025. The DORA implementation is a crucial step in enhancing the IT security of financial entities. Its primary aim is to bolster the IT security of banks, insurance companies, and investment firms. As a result, DORA ensures that the European financial sector remains resilient even during severe operational disruptions. Furthermore, here’s how it advances cyber resilience:

Key Components of DORA Implementation

- Risk Management: DORA requires financial institutions to implement comprehensive ICT risk management frameworks. Specifically, these frameworks must encompass the identification, protection, detection, response, and recovery aspects of cybersecurity. Regular risk assessments and updates to these frameworks are mandated to adapt to the ever-changing threat landscape.

- Incident Reporting: The regulation establishes a standardized incident reporting mechanism. Therefore, financial entities are required to promptly report significant ICT-related incidents to the competent authorities. This ensures a coordinated and swift response to mitigate the impact of such incidents.

- Operational Resilience Testing: DORA mandates periodic testing of the ICT systems of financial institutions. In particular, these tests, including threat-led penetration testing (TLPT), help identify vulnerabilities and validate the effectiveness of existing security measures.

- Third-Party Risk Management: The financial services sector is highly interconnected, necessitating careful management of third-party ICT service providers under DORA. Thus, financial institutions must ensure their service providers adhere to strict security standards and are integrated into their risk management framework. Additionally, considering third-party providers within these mechanisms enhances protection for institutions, their operations, and their data against potential threats.

- Information Sharing: The regulation promotes the sharing of cyber threat information among financial entities. This collaborative approach enhances the overall resilience of the sector by fostering a collective defense mechanism against cyber threats.

Building a Cyber-Resilient Future

DORA implementation marks a significant step forward, but a holistic approach is crucial. Here are some additional measures financial institutions can take:

- Security Awareness Training: Empower employees to identify and report suspicious activity.

- Strong Authentication Protocols: Implement multi-factor authentication for enhanced security.

- Regular Security Assessments: Identify vulnerabilities and patch them promptly.

- Culture of Security: Foster a culture where cyber resilience is a core value.

By prioritizing cyber resilience and embracing regulations like DORA, financial institutions can build stronger defenses and navigate the ever-changing threat landscape.

Embrace the Future with Confidence

For security and IT leaders looking to navigate DORA compliance, Xygeni can effectively clear a path forward toward a secure and resilient future. By partnering with Xygeni, you are not only making a strategic investment but also ensuring a future where your digital operational resilience significantly enhances your operational success.

Join the Movement: Redefining Financial Resilience

Let Xygeni guide you in achieving DORA compliance and beyond. Furthermore, see how Xygeni’s innovative approach can transform your financial institution, thereby setting new standards for security, compliance, and superior performance.

Practical Steps for Implementing DORA to Enhance Cyber Resilience

- Assess Current Capabilities: Conduct a thorough assessment of your existing cyber resilience measures and identify gaps that DORA can help address.

- Develop a Comprehensive ICT Risk Management Framework: Align your risk management practices with DORA’s requirements to ensure a robust defense against ICT threats.

- Establish Incident Reporting Protocols: Create clear and efficient reporting mechanisms to comply with DORA and improve your incident response capabilities.

- Regularly Test Operational Resilience: Implement a regimen of continuous testing and simulations to ensure your systems can withstand and recover from attacks.

- Strengthen Third-Party Management: Vet and monitor third-party service providers to ensure they comply with DORA’s security requirements.

Beyond Compliance: Xygeni – Your Guide to Operational Excellence

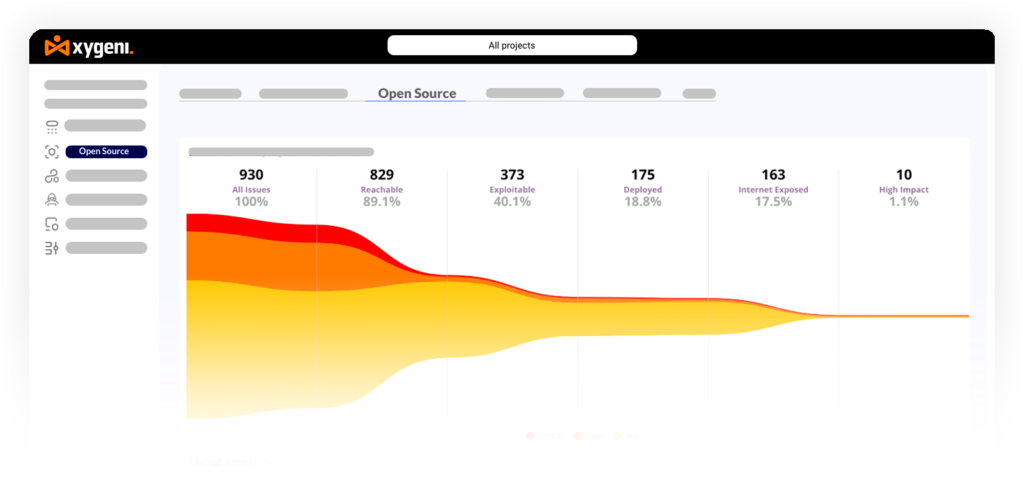

DORA sets a minimum standard for cyber resilience; however, proactive organizations can go beyond it. This is where Xygeni adds value. Specifically, this platform helps financial institutions not only meet but exceed DORA compliance, thereby ensuring success in the digital era. Furthermore, Xygeni provides end-to-end solutions tailored to DORA, significantly enhancing security and stability for financial institutions. Consequently, the Xygeni product includes the following features:

Risk Management

Xygeni’s inventory tool significantly enhances risk management by providing a dynamic and detailed inventory system for the entire SDLC ecosystem, including software assets and infrastructure. Moreover, this system organizes assets by type, ownership, and purpose, thereby creating a structured overview of the SDLC environment.

Anomalous Behavior Detection

Xygeni’s Anomaly Detection mechanism supports DORA’s objectives by offering real-time detection capabilities, comprehensive monitoring, and incident documentation. Consequently, this ensures continuous surveillance over the IT environment for software development. Furthermore, it identifies suspicious activities that deviate from normal patterns.

Incident Management

Digital Operational Resilience Testing

Additionally, Xygeni offers both basic and advanced testing capabilities, including secrets leak detection, Infrastructure as Code (IaC) analysis, malicious code detection, and CI/CD verifications. These capabilities contribute to fulfilling DORA’s requirements for thorough resilience testing.

Third-Party Risk Management

Xygeni’s Open Source Security and Early Warning Service detects vulnerabilities within third-party components, providing detailed reports and proactive alerts. Additionally, this supports DORA’s mandates for managing ICT third-party risks.

Conclusion

This awareness is a key feature for modern businesses. Their cyber resilience allows them to keep growing despite constant cyber attack threats. By incorporating DORA principles and requirements, businesses can develop an effective and solid operational framework. Moreover, embracing DORA means not only meeting regulatory requirements but also strengthening overall cyber resilience, which protects operations, reputation, and customer confidence.

Moreover, this ensures that an organization can build strong defenses against cyber threats. Achieving strong cyber resilience and DORA compliance will help security and IT leaders deliver operational excellence. Partnering with Xygeni strategically positions an organization to excel not only in compliance but also in the digital age.