Financial institutions face growing regulatory pressure to secure their digital infrastructures. One of the most significant regulations shaping this landscape is the Digital Operational Resilience Act (DORA). With DORA’s compliance deadline fast approaching in January 2025, financial entities must strengthen their digital resilience, especially in third-party risk management (TPRM). Under DORA’s fourth pillar, institutions must manage third-party risks effectively to prevent vulnerabilities external vendors introduce. Third-party risk management software plays a key role in simplifying this process and ensuring compliance.

To help you navigate DORA’s impact and get ready for compliance, we also want to share with you our SafeDev Talk Episode —“Get Ready for DORA: Secure Your Financial Institution’s Future.” This webinar is designed to guide you through the key challenges of TPRM and operational security.

The Growing Importance of Third-Party Risk Management

Third-party risk has become a top concern for financial institutions. A recent study revealed that 41% of companies experienced a significant breach tied to a third-party vendor in the past year. DORA addresses these challenges by requiring financial institutions to conduct thorough risk assessments of their third-party providers and maintain robust monitoring systems for continuous oversight.

Failing to comply with DORA can result in hefty fines and major operational disruptions. That’s where Xygeni’s tools make a difference, offering the critical support institutions need to meet these stringent demands.

Why Third-Party Risk Management Matters Under DORA

Third-party relationships bring many benefits. They allow financial institutions to adopt new technologies and improve efficiency. However, they also introduce cybersecurity risks. A single weakness in a third-party system can lead to malware, data breaches, or operational downtime.

DORA mandates that financial institutions are responsible for their vendors’ security. This includes:

- Continuous vendor monitoring

- Comprehensive security assessments

- Incident reporting

Non-compliance can result in severe penalties. The Office of the Comptroller of the Currency (OCC) highlights that mismanaging third-party risks can disrupt operations, harm reputations, and trigger regulatory fines.

Achieve Seamless DORA Compliance with Xygeni’s Third-Party Risk Management Software

Xygeni’s third-party risk management software offers a comprehensive, streamlined solution to help financial institutions efficiently manage third-party risks and stay compliant with DORA’s fourth pillar. Our platform is designed with financial institutions in mind, simplifying the entire risk management process—from vendor assessments to real-time monitoring and compliance reporting.

Here’s how Xygeni’s solution stands out:

Automated Risk Assessments:

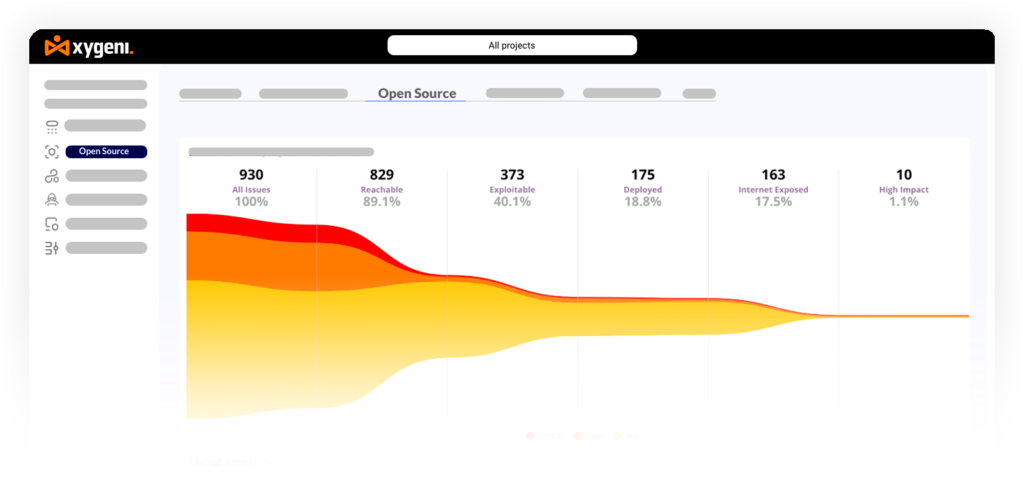

Xygeni automatically evaluates third-party vendors by scanning their software components for vulnerabilities and potential security risks. The platform uses an intelligent risk-scoring system, prioritizing threats based on their severity and likelihood of exploitation. This allows you to focus on the most critical issues, ensuring that you remain compliant with DORA’s requirements.

Real-Time Threat Detection and Early Warning System:

Xygeni’s Early Warning System continuously monitors third-party vendors, detecting any changes in risk profiles or suspicious activity in real-time. The platform sends out instant alerts, enabling your team to take proactive measures and avoid security breaches before they occur. This feature goes beyond traditional solutions, offering immediate action and risk mitigation as new threats arise.

Seamless Integration into CI/CD Pipelines:

Unlike many other platforms, Xygeni fully integrates with your existing CI/CD pipelines. This ensures that your development processes remain secure from the moment a third-party component enters your pipeline to the final deployment. Xygeni’s security gates block the introduction of risky or non-compliant software packages before they can compromise your system, making it an invaluable tool for financial institutions operating under DORA’s strict security requirements.

Advanced Compliance Reporting and Audit Trails:

Meeting DORA’s reporting obligations is a challenge for many institutions. Xygeni’s platform simplifies this with detailed audit trails and comprehensive compliance reports, automatically generated as part of your daily operations. The platform tracks every change in vendor status, risk scores, and incident responses, providing an audit-ready report that satisfies DORA’s rigorous documentation standards.

Vulnerability and Incident Response Automation:

Xygeni accelerates incident response by automatically flagging, quarantining, and blocking suspicious third-party components. Our platform allows your security team to respond quickly to vulnerabilities without disrupting your development workflow, reducing the risk of non-compliance or security breaches.

Built-in License and Legal Compliance:

With increasing regulatory scrutiny, Xygeni provides built-in tools to manage third-party licenses and legal compliance. Our software offers visibility into potential open-source license risks, helping your institution avoid legal complications while ensuring compliance with both DORA and other financial regulations.

Best Practices for Managing Third-Party Risk

To comply with DORA’s fourth pillar, financial institutions should follow these best practices:

Centralize Vendor Data:

Maintaining a centralized, updated inventory of all third-party providers and their risk profiles is crucial for managing third-party risk efficiently. Xygeni’s platform simplifies this process by consolidating all vendor data into a single dashboard, providing real-time updates, and enabling better decision-making. This approach ensures that your institution maintains visibility over all third-party relationships, significantly reducing the complexity of managing third-party risks.

Enforce Contractual Obligations:

Ensure that contracts with third-party vendors include specific clauses around ICT risk management and incident reporting. Xygeni’s platform helps track compliance with these contractual obligations, providing automated reports on vendor adherence to security standards and response protocols.

Implement Continuous Monitoring:

Use automated tools like Xygeni’s TPRM software to continuously monitor vendors and detect risks early. Xygeni’s real-time monitoring and early warning system give your team immediate insights into vendor behavior, allowing you to address potential risks before they escalate into larger threats.

Secure Your Third-Party Ecosystem with Xygeni

With DORA’s compliance deadline approaching, managing third-party risks must be a top priority. Xygeni’s third-party risk management software automates risk assessments, monitors vendors continuously, and ensures your institution complies with DORA’s fourth pillar.

This blog is part of our DORA series, covering key pillars of the regulation. For more insights, read our posts on the First Pillar: ICT Risk Management and the Second Pillar: ICT Incident Management.

Ready to enhance your third-party risk management? Request a demo of Xygeni’s comprehensive solution today and ensure your organization is fully prepared for DORA’s compliance requirements.