The Digital Operational Resilience Act (DORA), enacted by Regulation (EU) 2022/2554, boosts the financial sector’s resilience against ICT-related issues. Consequently, in our series on DORA’s five pillars, we now focus on ICT Incident Management. This pillar helps financial entities respond to and recover from disruptions swiftly, thereby preserving economic stability and consumer protection.

Understanding ICT Incident Management Under DORA

The increasing reliance on ICT systems within the financial sector drives the adoption of DORA.

Accordingly, the potential impact of ICT incidents on financial stability and market integrity has gained prominence. Here are key terms relevant to DORA:

- ICT asset: Software or hardware in the network and information systems used by a financial entity.

- Cyber threat: Any circumstance or event that could damage, disrupt, or adversely impact network and information systems.

- Vulnerability: A weakness or flaw that can be exploited.

- Digital Operational Resilience Testing: Regular testing of ICT systems and staff to uncover and address vulnerabilities, including basic and advanced tests like TLPT.

Core Components of Incident Management under DORA

It outlines key elements for incident management arrangements and requires every financial entity to implement them. These elements ensure that ICT incident management capabilities meet DORA’s stringent requirements.

Incident Detection

First and foremost, effective incident management is initiated by timely incident detection. In this regard, financial entities should implement mechanisms for the continuous monitoring of their ICT systems. Specifically, these mechanisms must be capable of detecting anomalies that may signify security breaches or operational disruptions. To achieve this, advanced monitoring tools are necessary, as they provide real-time, in-depth visibility into network activities.

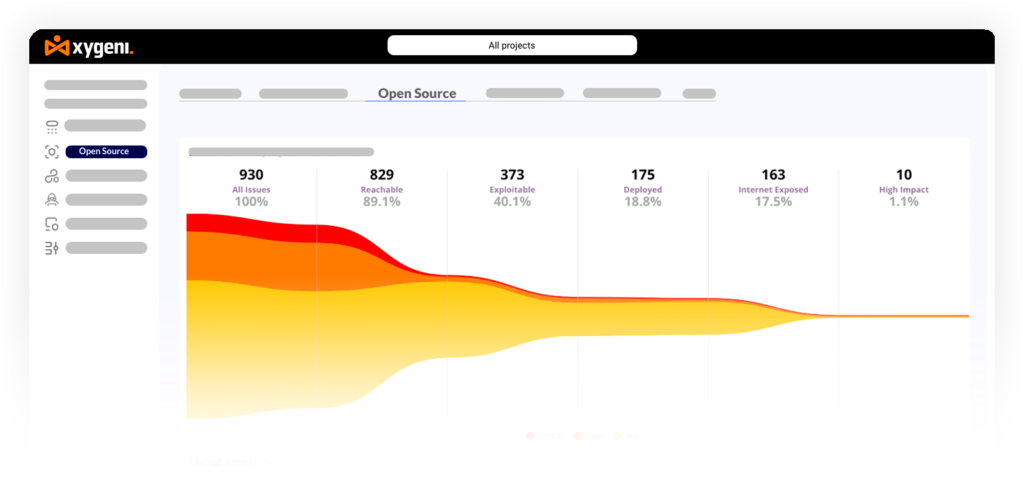

For example, in this regard, the anomaly detection system from Xygeni is unparalleled as it provides endless surveillance of the network in order to detect deviations from the usual patterns of activity. In this regard, constant monitoring for deviations guarantees that an entity detects a cyber threat or system failure in advance. Additionally, creating automatic notifications alerts relevant personnel immediately after detecting suspicious activity. Xygeni’s platform supports this by setting up automated alerts that notify personnel on time. As a result, this ensures that we act promptly to contain the incident before it escalates.

Incident Logging and Classification with ICT Incident Management

Once an incident is detected, it must be meticulously logged and classified to ensure appropriate response measures are taken. Comprehensive logging involves recording detailed information about the incident, including time, nature, and affected systems. Furthermore, systematic classification of incidents by severity and impact is crucial. It enables prioritization and efficient resource allocation. This systematic documentation not only enhances post-incident analysis but also ensures regulatory compliance.

Incident Response and Recovery

Effective response and recovery procedures at incident time can minimize their impact. Procedures for immediate response actions, like isolating affected systems, are quite important in a financial entity. For instance, tools provided by Xygeni give multi-level observation, which permits very early detection of security weaknesses at each stage—from a developer’s workstation to CI/CD pipelines—so probable vulnerabilities are noticed in good time and fixed to enable immediate response actions. Furthermore, Xygeni supports robust recovery processes by ensuring that only secure, compliant code progresses through the SDLC. This aids restoration to normal operations post-incident. This all-rounded approach will ensure operational continuity within the financial entities and better responsiveness in case of incidents, hence remaining resilient.

Incident Reporting

DORA mandates that financial entities report significant ICT-related incidents to the relevant authorities, informing all stakeholders and allowing them to take appropriate measures.

Ensuring timely reporting within specified timeframes is critical, and ICT Incident Management can help you out. Therefore, financial entities must establish standardized reporting formats to meet regulatory requirements. These reports should include comprehensive details about the incident, including the nature of the incident, the systems affected, the response measures taken, and the impact of the incident. Adherence to standardized reporting formats facilitates understanding and action by regulatory authorities, thereby enhancing overall incident management effectiveness.

Post-Incident Analysis

After managing an incident, it is crucial to conduct a thorough analysis to identify root causes and implement improvements. This involves root cause analysis to investigate the underlying causes of the incident.

Detailed records and audit trails of incident management activities support thorough investigation and documentation. They capture insights and enhance future incident management efforts. Documentation of lessons learned from each incident helps to improve future incident management efforts and enhance the overall security posture. Additionally, integrating lessons learned into policies, procedures, and technologies helps prevent recurrence and fosters continuous improvement in incident management practices.

Leveraging advanced incident management capabilities enables financial entities to achieve greater digital operational resilience and align with DORA’s core requirements. Consequently, this integration of technology and compliance ensures that organizations handle ICT-related incidents confidently and efficiently, thereby maintaining stability and protecting consumer interests in the financial sector.

Complementing the First Pillar: ICT Risk Management

This article complements our previous discussion on the first DORA pillar, ICT Risk Management, available here. While ICT Risk Management focuses on identifying and mitigating potential risks, ICT Incident Management ensures that any incidents are well-handled to minimize their business impact.

Conclusion

ICT Incident Management is a critical aspect of achieving digital operational resilience under DORA. Specifically, advanced anomaly detection, comprehensive incident classification, and seamless management integration prepare your organization to handle ICT-related incidents confidently and efficiently.

Therefore, stay tuned for our next post in this series, where we will delve into the third pillar of DORA: Digital Operational Resilience Testing.