As financial institutions increasingly rely on digital technologies to deliver their services, the risk of cyberattacks, disruptions, and operational failures has grown significantly. The Digital Operational Resilience Act (DORA) addresses this challenge with its five key pillars, ensuring that financial entities across the EU maintain robust operational resilience. In previous posts, we explored DORA’s requirements for ICT risk management, incident reporting, and third-party risk management. Today, we focus on the third pillar: Digital Operational Resilience Testing.

This pillar is vital for ensuring that financial entities are not just responding to incidents but are actively conducting operational resilience testing to uncover weaknesses before they result in real-world consequences.

What is Digital Operational Resilience Testing?

Digital Operational Resilience Testing is a key part of DORA. It requires financial institutions to test their ICT systems regularly. These tests range from basic checks to threat-led penetration testing (TLPT). The goal is to find risks that could stop the institution from delivering important services.

DORA’s Article 25 states that testing programs should match the institution’s risk profile and size. Larger institutions must adopt more advanced testing strategies. This approach helps institutions detect, respond to, and recover from disruptions with minimal impact.

Key Components of Digital Operational Resilience Testing

Basic Testing Requirements

DORA requires financial institutions to perform regular basic tests. These tests include:

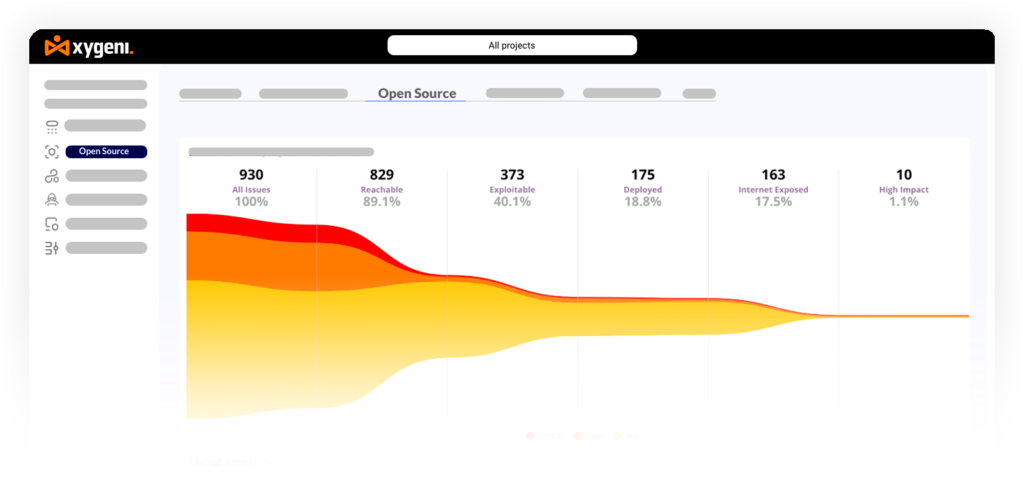

- Vulnerability assessments: Finding weaknesses in internal and external systems.

- Open-source software analysis: Ensuring third-party components used by the organization are secure.

- Network security assessments: Detecting and fixing risks in network setups.

- End-to-end testing: Simulating the entire operational process to find weak spots.

- Gap analyses and physical security reviews: Testing the effectiveness of both physical and digital security measures.

Advanced Testing: Threat-Led Penetration Testing (TLPT)

Larger institutions must perform TLPT, which simulates real cyberattacks. TLPT is one of the best ways to find vulnerabilities that attackers could exploit. This testing is crucial for institutions that manage core functions like payment systems and banking services.

Scenario-Based Testing

Scenario-based testing prepares institutions for specific threats, like cyberattacks or natural disasters. It simulates real-world events that could disrupt business processes.

Aligning with DORA’s Requirements: A Phased Approach

Financial entities must align their digital operational resilience testing with DORA’s standards. This process starts with basic testing and grows more advanced as the entity strengthens its resilience.

Regular, Structured Testing: DORA requires institutions to test their ICT infrastructure regularly. These tests ensure that both systems and the staff who manage them are ready for potential risks.

Tailored Testing Programs: Institutions must create customized testing strategies. Smaller institutions may only need basic testing. Critical operations require threat-led testing.

Continuous Improvement: Institutions must review test results and find areas for improvement. This process keeps their systems strong and helps them adapt to new threats.

How Xygeni Enhances Digital Operational Resilience Testing

At Xygeni, we know that meeting DORA’s resilience testing requirements takes more than basic scans. Our platform offers tools designed for both basic and advanced testing.

Secrets Detection: Xygeni helps find hard-coded secrets, like passwords and API tokens, to prevent unauthorized access.

Infrastructure as Code (IaC) Analysis: Our tools check your infrastructure configurations for security gaps. This ensures systems stay safe during resilience testing.

Malicious Code Detection: Xygeni scans software for malicious code, which is essential for protecting against backdoors and data leaks.

CI/CD Pipeline Security: We integrate security checks into your CI/CD workflows, enforcing security throughout your software delivery.

Do you want to know more about DORA Resilience Testing?

Watch our SafeDev Talk Episode DORA Compliance to learn more about Resilience Testing and other regulations affecting the EU!

Staying Ahead of Emerging Threats with Proactive Testing

Financial institutions are prime targets for cyberattacks. Regular resilience testing is critical to staying ahead. Proactive operational resilience testing helps institutions find and fix vulnerabilities before they become dangerous.

Xygeni’s proactive tools allow financial institutions to meet DORA resilience testing standards. By automating alerts and continuous monitoring, institutions can quickly detect and resolve threats. This ensures secure operations.

Fortify Your Digital Operational Resilience

DORA’s third pillar—Digital Operational Resilience Testing—focuses on preparedness. Regular testing, tailored to each institution’s needs, is key to maintaining operational resilience. By aligning your testing with DORA’s standards and using Xygeni’s powerful testing tools, your institution can safeguard its systems from evolving threats.

Stay tuned as we explore the final pillar of DORA. Xygeni is here to support you in achieving full compliance and enhanced resilience.